AI is revolutionizing the finance world! Learn about AI's role in fintech, fr...

In recent years, artificial intelligence (AI) has become a mandatory part of the financial sector. Like other industries, the use of AI in fintech is booming exponentially with the highest adoption rate.

In fact, the global value of AI in the fintech market was $8.23 billion in 2021 and is expected to reach $61.30 billion in a decade. A whooping high surge! From automating financial processes to fraud detection to enhancing customer experience, AI has changed the financial industry like never before.

Well, in this guide, we’ll cover what AI in fintech is, how to use AI in finance and how AI is helping to improve the finance industry with advanced features and better customer service.

The integration of AI in fintech has started a new era of development. But what exactly is fintech? Fintech is a short form of financial technology, and artificial intelligence in fintech uses AI and technology to automate and improve financial services.

A prime example of this is leveraging technology in the banking system. The old pen and paper manual method is out of date. Now, AI has replaced traditional processes and excels in payment procedures, account protection, AI chatbot customer service, etc.

These chat support systems, like the one offered by Aidbase, depict the union of fintech and AI, making financial services quite efficient and accessible. Here, the question is, which technology helps in the working of AI in fintech?

Well, it's machine learning, natural language processing (NLP), cognitive computing and predictive analysis working together to empower the financial institutions. Fintech companies use these technologies to examine customer data for better customer experience.

The financial sector is rapidly evolving, with unique innovations every other day. From the advent of ATMs to cardless money withdrawals to not having to leave home for transactions, the financial industry has come so far.

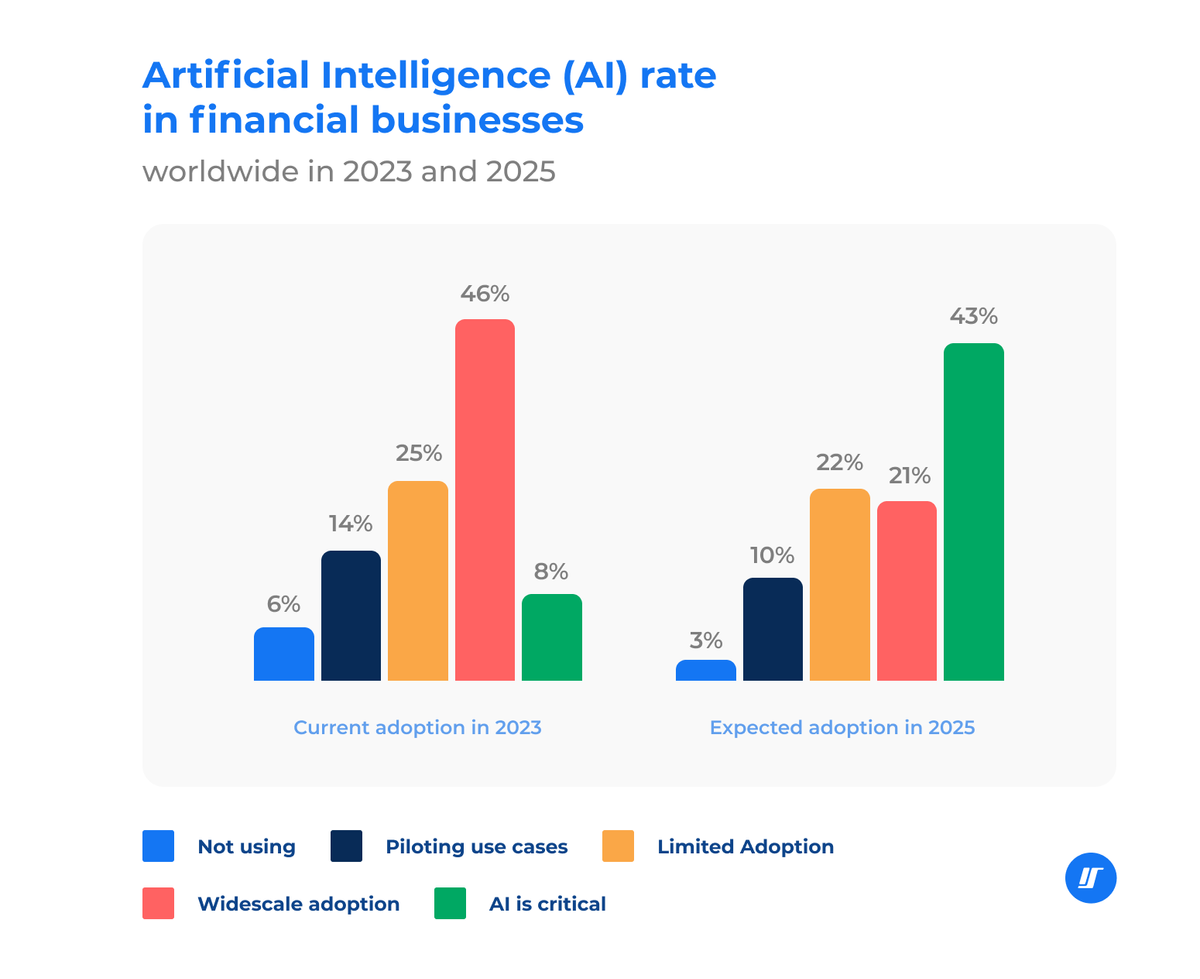

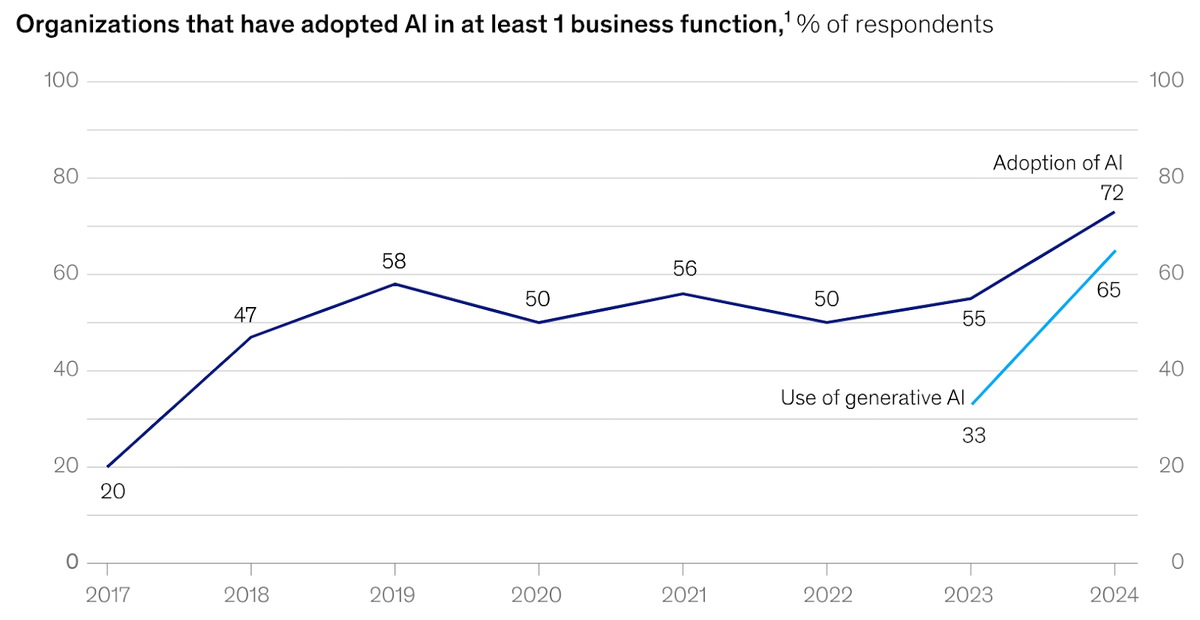

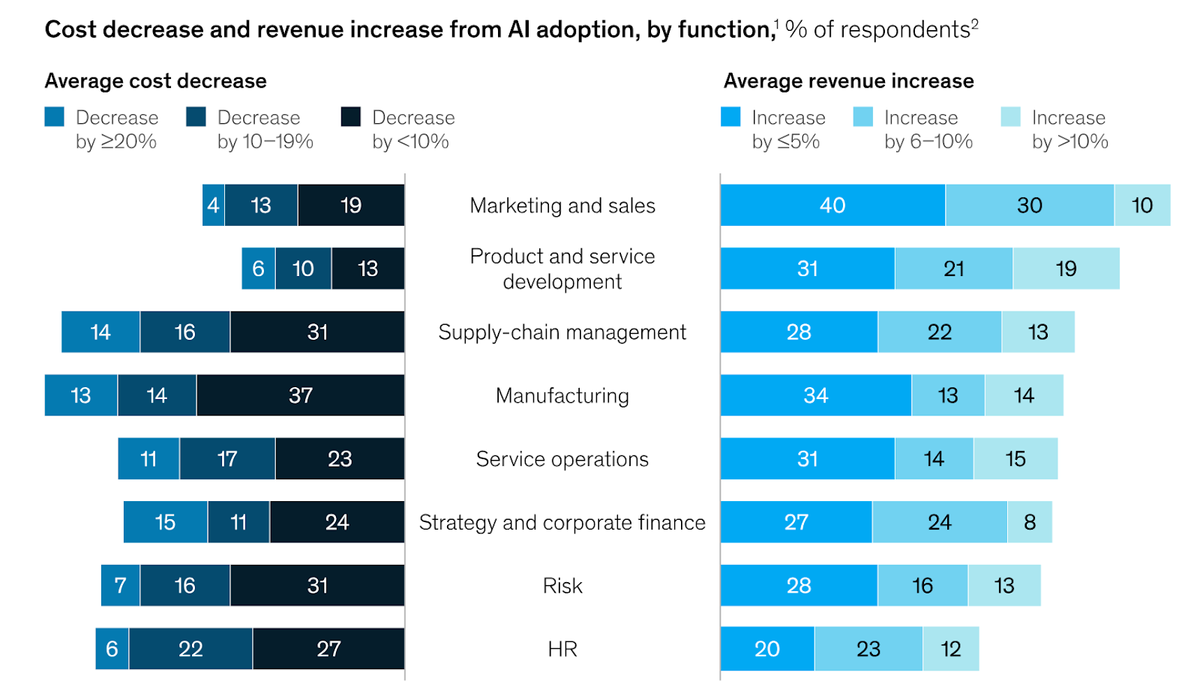

With AI in fintech, companies are becoming increasingly adept at managing numerous tasks. According to McKinsey survey reports, AI adoption has peaked at 72%, with businesses using AI in at least two or more functions providing immense value. Let's look at how AI in fintech is changing the dynamics of the financial industry with an unmatched revolution.

Source: McKinsey & Company

The fintech businesses are the biggest targets of fraudulent acts. Studies have shown that online fraud activities increased to 149% in 2021, while account takeovers reached 427% in 2023.

The traditional way of detecting fraud was manual, which couldn't keep up with new fraud tricks. But AI in finance is a real game-changer to catch such activities. This new technology uses advanced machine learning algorithms to analyze vast data from past transactions and categorize it into legitimate and fraudulent. Also, it keeps learning and self-adapting over time, which can help locate even minute suspicious activity.

AI efficiently detects unusual activities like customer account theft. It notifies them and provides multi-step verification procedures to prevent identity theft.

Also, phishing emails aim at stealing passwords and credit card details, but machine learning algorithms identify such emails and categorize them as spam to prevent fraud risk. It can even accurately locate documents forgery like fake IDs, and signatures, and differentiate them from original ones.

Do you know that AI can reduce credit card fraud by $31 billion annually?

Customer satisfaction is the number one priority of businesses. With AI-powered customer service, any industry can provide the best services for their users and using AI in finance sector is no exception. It is expected that by 2025, AI will manage 95% of interactions between customers and financial institutions.

AI in fintech provides personalized support to customers seeking banking or financial services assistance. This can be done by tools like chatbots, virtual assistants, ticketing systems and sentiment analysis. These AI-powered support systems can be easily integrated into financial institutions’ platforms. Aidbase is the best example, which helps you create chatbots and custom ticket forms without any hassle.

AI virtual assistants are available 24/7 and address queries in a second. They provide customized financial recommendations and are trained to respond in any language. By analyzing customers’ feedback and sentiments, banks can improve features, resulting in better customer experience, trust and loyalty.

With AI, financial institutions can offer personalized experiences to 83% of their customers.

Financial institutions have incorporated AI to prevent crimes like money laundering. But how does AI in fintech do this critical task?

Well, artificial neural networks and advanced machine learning algorithms assess vast amounts of transaction data in real-time and fetch unusual activities. AI’s advanced feature uses pattern recognition to identify links between individuals involved in extended money laundering.

ML algorithms make profiles of customers and store normal behavior and patterns such as area, frequency and type of transaction. This helps them track risk levels and abnormal activities.

Also, the risk of false positives in anti-money laundering alerts is possible, but AI is able to tackle using advanced machine learning algorithms. In this way, AML teams become more able to focus on actual cases than false alerts.

By 2025, AI for anti-money laundering applications is expected to grow at a CAGR of 21%.

With the rise of AI in finance, investment management has become relatively seamless. Businesses are relying more and more on AI for financial management and advice. According to reports, nine out of ten financial advisors believe that AI can help grow their business organically by more than 20%.

With so many robo-advisory apps, fintech companies are comfortable with AI automating different processes. AI can provide finance advisors with investment research and analytics. Also, it helps advisors plan better advice on taxes, savings or inheritance.

Moreover, apps like Cleo provide users personalized money management tips based on their goals. The best part is that fintech AI provides their customers with real-time investment insights and whether a particular investment suits them. It shares market trends, stock price and portfolio performance by analyzing a vast set of market data. This helps customers make better decisions.

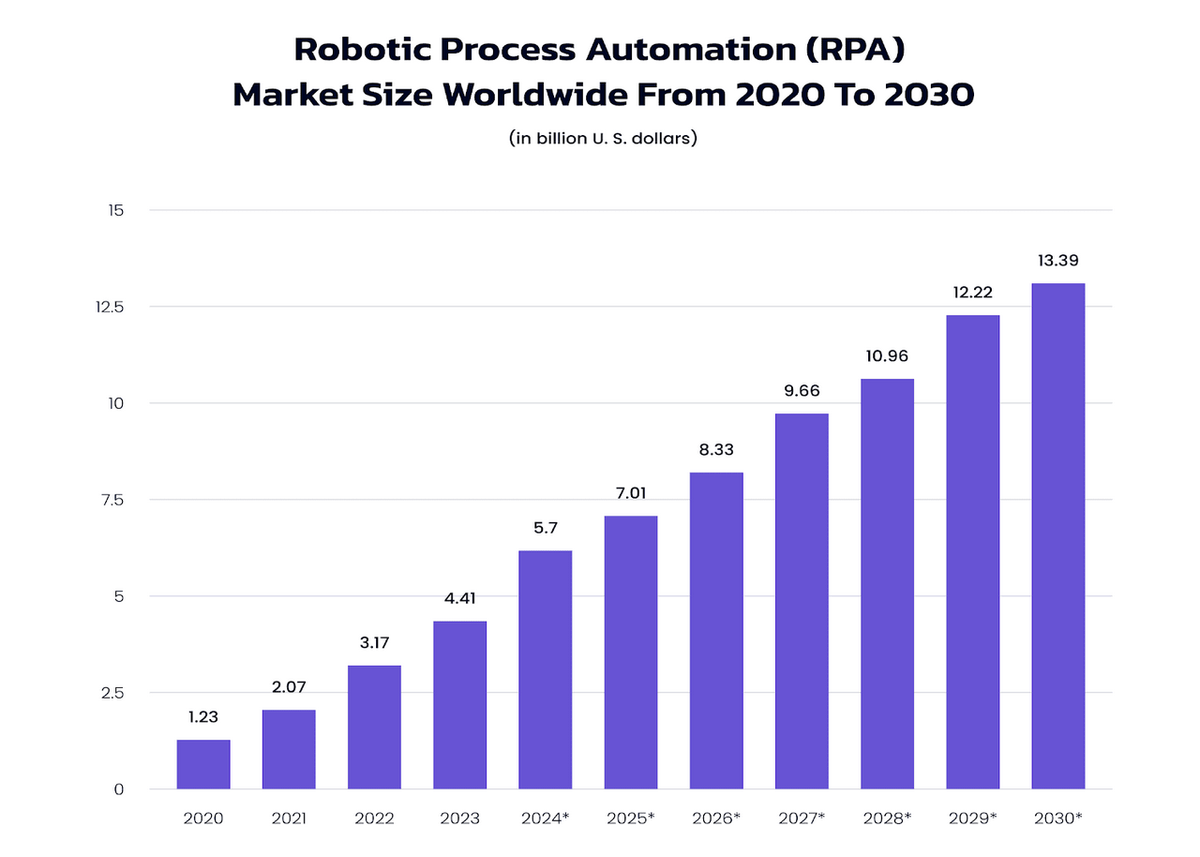

Robotic Process Automation, or RPA, is one of the most valuable applications of AI in finance. It is a technology used in the finance sector to automate repetitive tasks like data entry, account opening, loan processing, transactions, or customer support.

These bots work like humans and manage virtual assistant tasks. RPA in fintech works by reviewing detailed workflows and training on what should be done in each step.

Reviewing and approving customers' data is cumbersome and prone to human error, but this process has become quite smooth with AI in fintech. It can also automate routine tasks based on predetermined schedules like license renewal, and any subscription or recurring fund transfers without worrying about it.

With RPA, fintech companies can respond to their users quickly with repetitive questions, leaving happy customers.

The global RPA market size was $1.40 billion in 2019 and is expected to increase by $11 billion in 2027.

Source: Statista.com

Fintech and financial institutions leverage AI to better understand customers offering personalized services or deals. The large neutral networks used in deep learning efficiently derive customers’ data, actions and outcomes.

When a customer calls, the speech recognition model transcribes the conversation data using natural language processing fed into the system. This, in turn, helps improve sentiment and customer service with appropriate solutions.

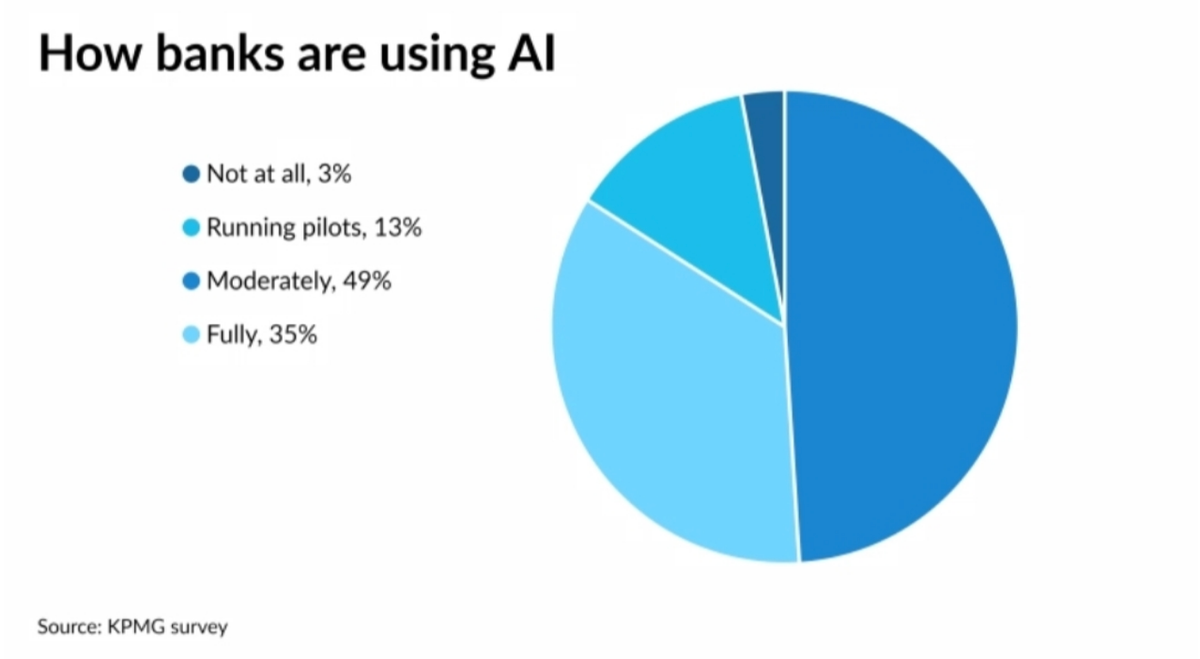

Nearly 80% of banks are aware of the potential of artificial intelligence. This AI inclusion and personalization help achieve significant revenue growth of 10-15%. Moreover, it can lift a bank's annual revenue by 10%.

So, customers are more likely to be loyal and satisfied when they get timely help through chatbots, as well as personalized and relevant offers and advice.

According to McKinsey reports, with AI, global banking can potentially deliver additional value of upto $1 trillion.

Source: KPMG survey

Integration of AI for fintech sector is essential for securing sensitive information. Gone are the days of traditional methods like passwords and pins, which are vulnerable to hacking or fraud. Now, biometric methods are being used for advanced security. It is the use of AI algorithms to analyze biological data for verification purposes.

Unique physical characteristics like fingerprints, facial features, iris scans and voice patterns are investigated to identify individuals, preventing unauthorized people from accessing sensitive data. In fintech, AI biometric technology provides more security and fosters customer trust.

Additionally, the fintech industry and banks can use biometric verification to identify individuals and mitigate the risk of money laundering and fraud. With this, transactions through apps have become quite efficient and speedy, with fewer errors than are possible with manual processes.

The global value of fintech biometrics is expected to rise from $332 billion in 2022 to $1.2 trillion by 2027, according to Juniper research.

With the adoption of AI in fintech, the benefits are super intriguing, such as;

Almost 44% of businesses are using AI to lower costs and improve savings, according to McKinsey reports. The AI saves fintech industries trillions of dollars to use them in any other arena.

While the hiring costs are higher and getting work done manually is time-consuming, AI automation saves time and money.

By providing customer service, tailored advice, preventing fraud, and conducting credit underwriting, AI saves money in all these domains. Besides, it increases revenue and profit at the same time.

The work done with well-trained AI is more efficient and without any error, which is possible with human work. It can gather vast data and analyze it in minutes to see what works and what doesn't.

The collected data is used to assess customers behavior, and preferences to create personalized products and services. Nearly 48% of companies use AI in fintech to analyze quality data.

Almost 66% of financial institutions invest in AI to improve customer service. In this fast-paced digital world, customers can't wait for hours to get a solution to their queries.

However, AI is a real help for customers and fintech businesses alike. AI can be available around the clock for quick tasks like customer questions and transactions so employees can manage more critical inquiries.

Chatbots are even trained to assess sentiments, close any communication gaps and improve customer experience.

Erica is Bank of America’s artificial intelligence, which is integrated into the bank’s mobile app and provides virtual assistance using advanced AI technology. It assists in providing personalized and efficient backing experiences to their customers.

Through voice and text form, Erica responds to customers by telling account balance, transaction history, making payments and budgeting insights.

Singapore’s bank DBS uses AI to improve the efficiency of credit processing operations. AI automation works to reduce processing time, assess credit and loan applications without any delay.

Aidbase is a robust full-fledged ecosystem which can create chatbots and custom ticket form for fintech companies to boost customer’s experience and collect information. Also, this tool can be easily integrated into the company's app.

A company named Vectra developed Cognito to mitigate cyber threats. This software detects cyber attacks, identifies attackers, and even finds compromised data.

Despite the addition of AI in finance sector with countless benefits, specific risks and challenges must be considered. The first concerning challenge is data privacy and security. Fintech companies should keep a balance between getting customers data and breaching privacy. Strong data protection measures like encryption control should be taken to ensure data safety.

Another challenge is transparency regarding how much AI will use customer data. AI is inevitable, but what's important is providing a clear and fair explanation of AI usage, resulting in users' trust and confidence. Additionally, cyber attacks are the biggest threat to the fintech industry, which should be countered by robust and rapidly evolving machine learning models.

Companies can't prosper without adopting artificial intelligence in their system. The reason is its capabilities to foster customer satisfaction as well as the company's productivity with top-notch automation. AI in fintech excels in detecting frauds, preventing money laundering, providing personalized experiences and boosting AI customer services. Hence, AI manages various trivial and repetitive tasks and also assists humans in analyzing huge amounts of data, freeing them for competitive work.

Looking for AI support for your fintech company? Switch to Aidbase! Its AI chatbot customer service is a game changer that provides excellent customer experience, building loyalty and trust.