Do you know how generative AI in banking is being used to automate redundant ...

Long lines, wasted hours, manual documentations, heaps of paperwork and whatnot. The past of banking services is no less than a nightmare. If you did not have to see a bank employee sort through bundles of papers to get to yours for a mere transaction, you are luckier than you give yourself credit for.

Though who to thank for such a big transformation? Inculcation of generative AI in banking. Over the past few years, it has taken banking services up several notches. Now over 68% of banks have employed generative AI in their systems.

Hang in there, we are about to look closely into the role of generative AI in banking and finance.

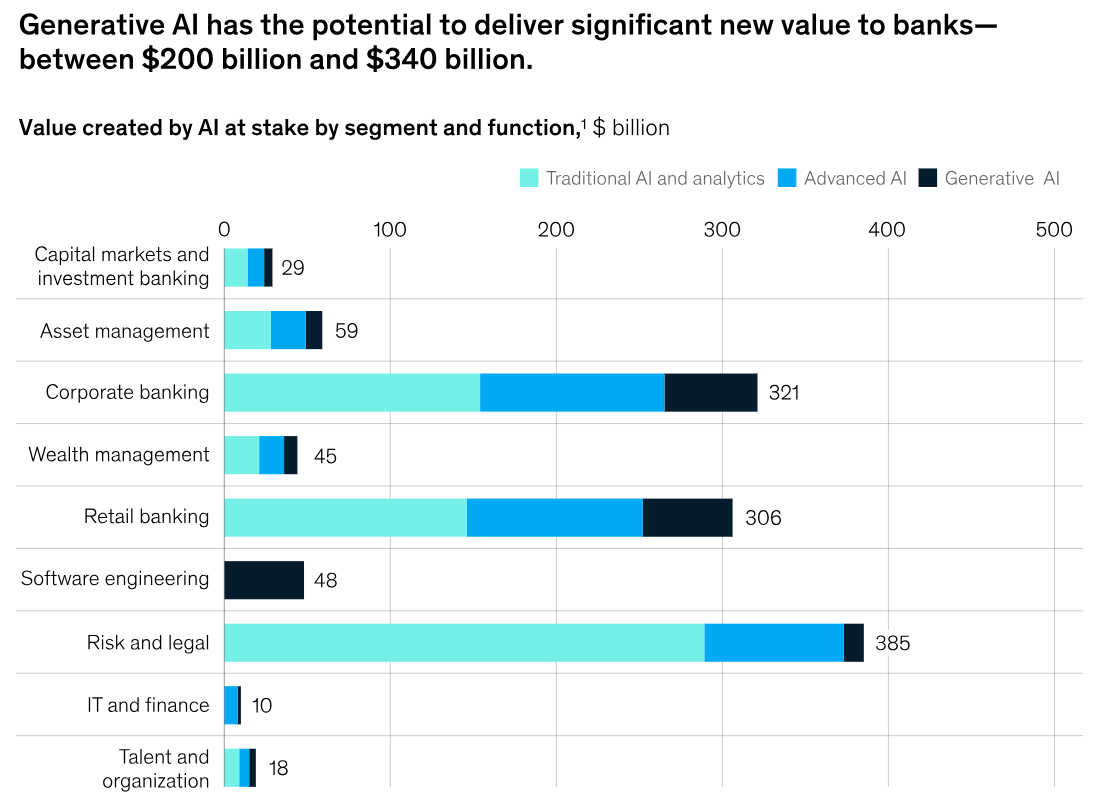

Thanks to the increasing use of artificial intelligence in financial services, generative AI was introduced in the banking sector. The results that this new development has produced can be easily seen. According to McKinsey Global Institute, the impact is so monumental that generative AI in banking can add around $200 billion to $340 billion to the global banking revenue annually.

Using the advanced machine learning models, generative AI has reshaped banking. Be it the customer service experience, creation of specialized language models for financial services, generative AI in banking has helped achieve it all. Instant replies from your bank are none other than generative AI’s doing. Since its advantages outweigh its challenges by a long shot, the integration of generative AI for finance is rapidly expanding.

Alt text: Value created by generative AI yearly

Credit: McKinsey

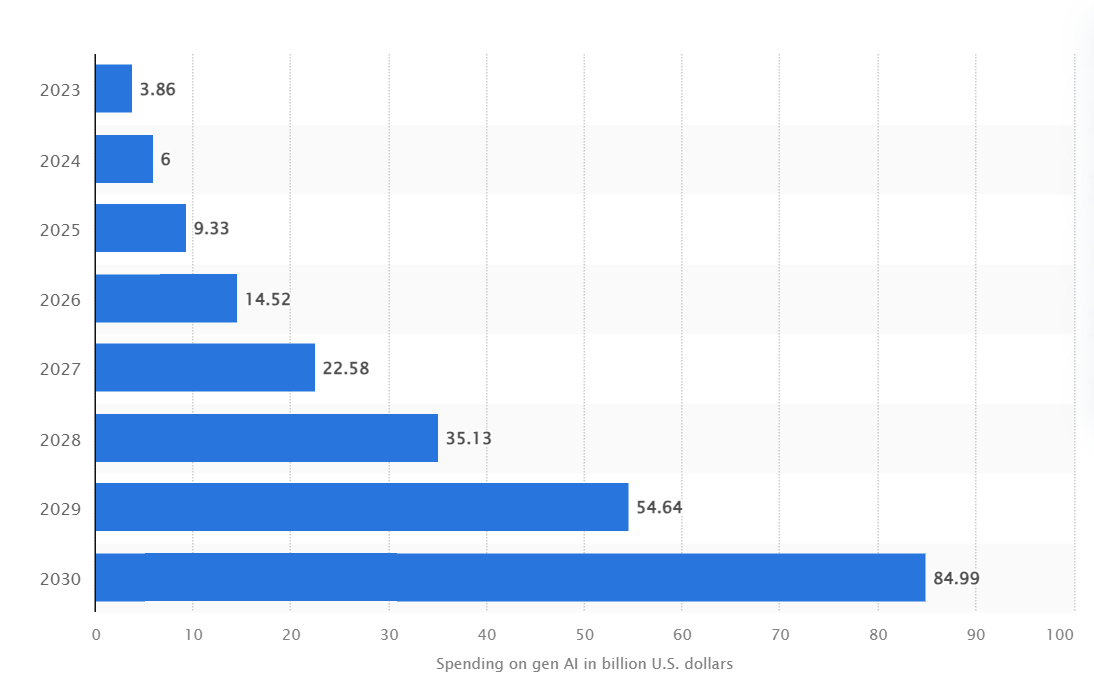

In the year 2023, the banking sector invested 3.86 billion US dollars on generative AI. Why is generative AI such a big deal that banks are pouring a lump sum of money into it? Well, the factors that have heavily influenced its adoption in recent years and will continue escalating its need can put the investment into perspective.

Generative AI banking is needed due to the following factors:

Estimated spending of the banking sector on generative AI from 2023 to 2030

Credit: Statista

Generative AI for banking has exponentially impacted the financial industry. From conversational banking to fraud detection, we can make the most of gen AI by employing it early on in your organization. Though many financial institutions are in the early stages of adopting AI, its potential sees no bounds.

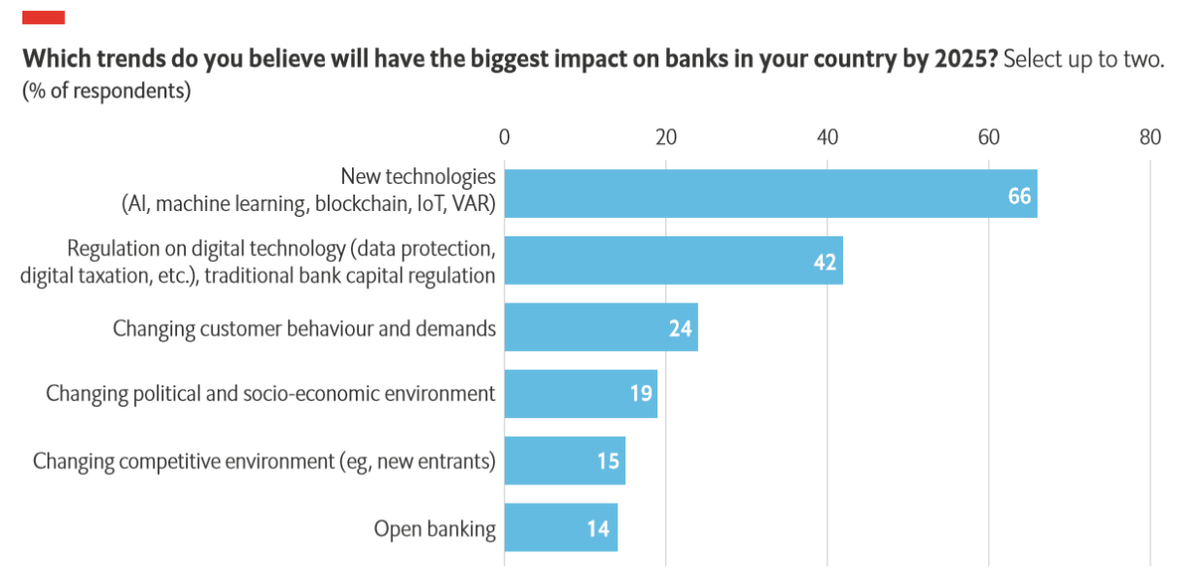

About 66% of bankers believe that new technologies like AI will have the most profound impact on the banking sector by 2025. If you, too, are interested in making the most of what generative AI in banking offers, read the generative AI use cases in banking listed below.

Trends with the biggest impact on banks by 2025

Credit: Economist

Working in the banking sector, no one is unfamiliar with customer service disasters. At one point or another, you must have dealt with a customer ready to close his/her account. Well, maybe we should wave goodbye to these disasters by implementing generative AI in banking.

72% of customers believe that products are far more valuable when customized based on their needs. Since achieving this manually is impossible, banks have opted a more advanced approach. By putting to use the ability of generative AI to thoroughly analyze individual customer data, banks have significantly improved their customer services.

Now, AI can review a customer’s transaction history and spending patterns to give them financial recommendations curated only for the customer. Doing so allows banks to better meet the specific needs of customers and improve their satisfaction.

What does a customer need? Instant response? Round-the-clock assistance? Well, no employee is going to sit in front of a screen 24/7 responding to every customer instantly. You know who can do that? Generative AI chatbots. They will entertain a customer instantly, all the while using a very human-like and natural language.

Moreover, the chatbots can help customers access their account balance, transaction history and other account services. Though that is not all, if a customer seems to need multilingual services or assistance with their disabilities, conversational AI can easily accomplish that too.

Even death cannot do us apart from unpaid bills and loans. Well, instead of letting customer’s payments pile up, generative AI sends them regular reminders of their payments, inquiries and personalized loan repayment suggestions. Plus when a customer is stuck and does not know what course of action to take, AI can come in handy. Be it recommending financial services, showing deposit options or offering financial plans, generative AI in banking can accomplish it all.

Customers expect personalized services from banks

Credit: Thefinancialbrand

In the banking sector, successful risk management and accurate credit scoring are important for maintaining financial stability and making sound decisions. Like everything else, generative AI has revolutionized these processes too by providing more precise and holistic assessments.

Generative AI analyzes vast datasets, like transaction history and economic indicators, to identify subtle patterns and correlations that traditional methods might miss. As a result, it reduces default risks and improves loan approval rates.

As far as risk management is concerned, avoiding potential risks can easily be handled by generative AI in banking. By analyzing historical data and providing early warning signs, generative AI in banking can detect risks. Hence, banks can adapt and mitigate potential financial losses more skilfully.

AI automates the analysis of financial history and current data of borrowers to reduce any manual errors. This automated process enables the banks to offer loans to a broader range of customers. Additionally, it streamlines loan underwriting and mortgage approval processes by using multiple sources to create comprehensive financial profiles of customers.

As the banking sector has advanced, the solutions for fraud prevention and investment strategies creation have too. With an uprising of cybercrime and growing complexity of the financial market, more and more banks are opting for generative AI. Its usage enhances their security, optimizes trading and forecasts financial trends.

Generative AI in banking continuously monitors transactions, and identifies and flags suspicious activities, such as unusual locations or spending patterns. To simulate various fraud scenarios, AI uses synthetic data. This synthetic data usage enhances the detection models and keeps them updated against emerging threats.

Manually analyzing market trends and vast amounts of market data requires a large workforce. To avoid wastage of the manual labor, generative AI in banking analyzes the market data. The data generally includes the historical trends, social media sentiments and economic indicators.

By putting this data to use, gen AI creates sophisticated trading algorithms. These algorithms can in return make rapid trading decisions, optimize returns while minimize risks. That is not all though, it also allows banks to rapidly adjust to market changes, explore new trading strategies and remain competitive.

Generative AI in banking is also very good at identifying patterns and simulating various economic scenarios. These abilities of gen AI are used by banks to make informed decisions about future investments. Usage of AI for investment banking allows financial institutions to evaluate potential risks and opportunities while improving their long term strategic plans.

The banking sector is highly competitive. In order to come out on the top, banks need to stay up-to-date and stand out from their competitors. Easier said than done. Though if a bank moves from its traditional practices to the recent market trends like generative AI in banking, it is already halfway through to beating its competitors.

AI analyzes customer behavior and preferences to create marketing campaigns based on the target audience. Moreover, it automates the creation of marketing materials and tracking the performance of the campaign that improves marketing ROI over time. Generative AI in banking also enables A/B testing to refine strategies and to ensure that campaigns resonate with the right audience.

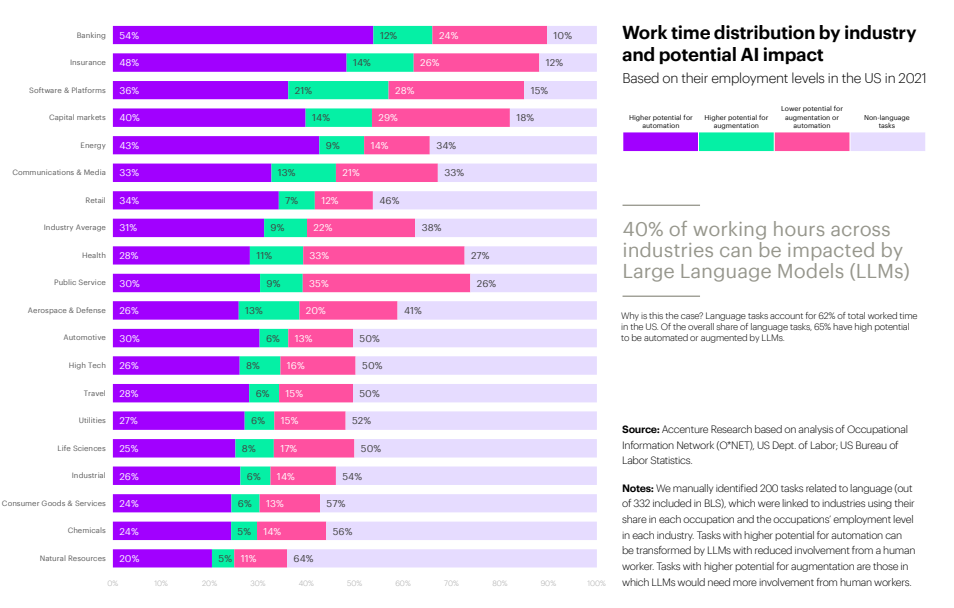

According to Accenture, banking has the most potential for AI automation i.e., 54%. It is, hence, one of the reasons that AI has become very helpful in reducing manual labor by automating redundant, routine tasks. It aids in the summarization of large documents which saves a lot of time and reduces the need for manual reviews.

Furthermore, by streamlining KYC (Know Your Customer) verification, AI accelerates customer onboarding, reduces false alarms and improves compliance with regulations. Banks are also using AI to automate internal processes like drafting clients communications, and generating responses to inquiries.

Banking industry has the most potential for automation

Credit: Accenture

Lastly, as far as generative AI in banking is concerned, it helps banks with complex regulatory processes by generating synthetic data and automating compliance tests. It, further, allows financial institutions to meet regulatory obligations swiftly and reliably. All in all, be it accuracy, speed or trustworthiness, generative AI can help banks accomplish it.

To successfully integrate generative AI in banking, its correct implementation is essential. Given below are some brief guiding steps to build a strong foundation for your generative AI initiatives.

Clearly identify business areas to prioritize for generative AI implementation. Once identified, define specific use cases, objectives and desired outcomes. Moreover, to ensure that the AI is compatible with the existing systems, evaluate your data infrastructure, and technology readiness.

For seamless implementation of gen AI in banking, invest in a modern infrastructure that is capable of supporting generative AI workloads. You can consider hybrid solutions to introduce generative AI in your financial institution. These solutions will combine private and public clouds for flexibility and security.

You can initiate pilot projects to assess the feasibility of the AI, its risks and performance. It is absolutely crucial that you train, deploy and evaluate the AI system on a small scale before scaling up.

To further ensure responsible AI usage and risk management, develop robust AI governance frameworks and control mechanisms. These measures should be applied to both internal processes and third-party tools.

Now that we have briefly looked into the use cases of gen AI in banking and its implementation, understanding its benefits will be a lot easier.

Generative AI automates routine tasks such as data entry, report generation and customer inquiries. It reduces manual labor which frees up employees to focus on higher-value activities that require human judgment and creativity. This optimization of workflows speeds up processes, increases output and overall operational productivity.

AI-driven chatbots offer constant support to customers which leads to quicker responses and better services. Moreover, it helps transform customer interactions by providing personalized experience, prompt support and access to relevant information across digital channels.

Generative AI in banking allows risk management by identifying potential risks more quickly and accurately. By further using AI to analyze large datasets, banks get to identify and mitigate risks. This leads to asset protection and financial stability in a financial institution.

Automation of routine tasks leads to significant cost reductions. By optimizing processes and eliminating manual tasks, banks can achieve substantial savings in labor, resources and operational expenses.

While generative AI offers significant benefits, its implementation does not come without challenges. Overcoming the challenges given below is crucial for realizing the full potential of generative AI.

Protecting sensitive financial data is very essential for banks. Though for generative AI models to fully function, large amounts of data is required. This sharing of sensitive financial data increases the risk of breaches and unauthorized access. Nevertheless, the issue can be solved through robust security measures that will safeguard customer information.

The banking industry operates within a complex regulatory framework. In order to integrate AI, it is necessary to carefully adhere to laws and regulations. Non-compliance to the laws in place can result in severe penalties and reputational damage.

AI models can inherit biases based on the training data which can lead to discriminatory outcomes. To maintain trust and avoid legal issues, ensuring fairness and equity in AI-driven decisions is necessary.

Integrating AI into existing banking systems can be complex and disruptive. In order to successfully implement generative AI in banking, it is essential to overcome these technical challenges and manage organizational change.

Generative AI in banking is set to transform the banking and financial sectors through its advanced solutions. Since more than 74% of executives believe that generative AI’s benefits outweigh its risks, more financial institutions are bound to adopt it. For now, it has helped enhance operational efficiency and customer experiences in banking though as the AI evolves, it will play a role in more crucial processes. These processes can include predictive analytics for risk management, refining credit scoring systems, and providing customized financial advice.

The integration of generative AI with existing banking systems is expected to streamline operations, reduce costs and improve decision making. Though its full potential will unfold gradually over the next few years. Initially, banks are likely to focus on incremental improvements like accuracy and compliance. Though as the technology advances and matures, it will be used to create personalized financial products, enhance financial forecasting and add to employee capabilities.

Generative AI benefits outweigh its risks

All in all, the noticeable evolution in the banking sector in recent years can easily be accredited to the use of generative AI. Not only has it proven itself as a game changer but also showcased its importance to stay ahead of the curve. With its redefined customer experience, gen AI in banking has really done a number on the previous customer service practices.

Through AI support utilized by banks, personalized customer services are becoming a norm. Though for personalization purposes, AI chatbot customer service is primarily in use. To make the most of these new practices, using a reliable chatbot can make all the difference. How to get one though? Not a problem when Aidbase is dedicated to revolutionizing customer service and customer experience through customized chatbots, with pricing starting at as low as $22 per month.

You can inculcate these chatbots in your banking services and modify them to your needs for the best AI customer service. Be ready for your customers to gush over your customer service because Aidbase will never disappoint you.

Generative AI is transforming the banking industry by:

Generative AI is a type of artificial intelligence that can create new content, such as text, images, music, or even video. It learns patterns from existing data and then generates new, original content based on that knowledge.

Example:

Financial Summaries: If a customer receives a monthly email about their spending habits, savings goals and potential areas for improvement, it would be based on their transaction history, financial goals and market trends. All this work would be done by AI.

AI-driven personalization and predictive analytics are emerging as key trends in banking. Personalized banking is based on the customer preferences and behaviors observed by the generative AI. On the other hand, predictive analytics help banks anticipate customer needs, market trends and potential risks.

In the future, AI will help banks in: